The share price of Purple Group, the parent company of online stock trading platform EasyEquities, closed trading at 95 cents, up from 77 cents at the beginning of trading this morning. The 23% jump comes on the back of the company announcing strong results. Revenue and profit were at R189 million (~$10 million) and R11 million (~$580,000), a 30% and 202% increase respectively.

EasyEquities meanwhile managed a profit swing of 171%, recording R11.8 million compared to a loss of R16.5 million last year. Interestingly, the company managed the profit swing despite a 1% decrease in operating expenses. Revenue increased by 35% to R165 million (~$8.7 million).

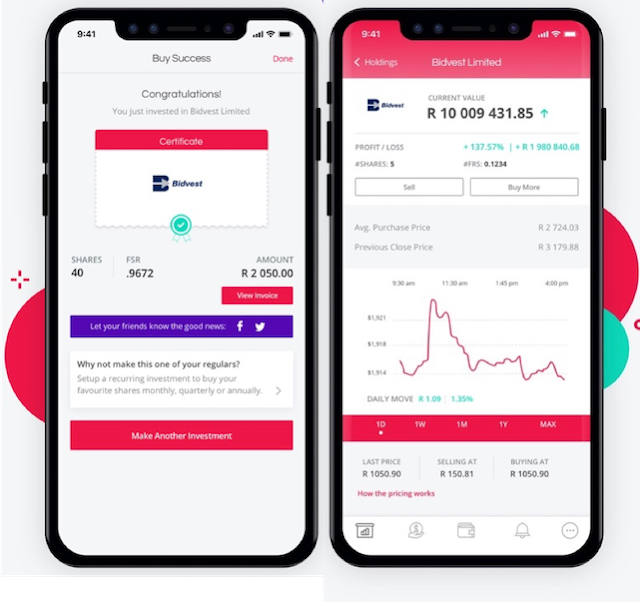

The platform’s active users and client assets increased by 12.5% and 20% respectively to 944,500 users and R51 billion (~$2.7 billion) respectively.

The company’s performance continues tech companies' strong presence in the South African equity markets. Last week, online used car retail company WeBuyCars was listed on the JSE after unbundling from parent company Transaction Capital. The strong tech presence might present public listings as a viable exit avenue for investors amid the funding slowdown.

Purple Group owns 70% of EasyEquities while the remaining 30% is owned by Sanlam, one of South Africa’s leading insurance companies.

“Following these results, it is clear that EasyEquities is now coming out of age and we can perhaps lose the “startup” tag,” said Charles Savage, Purple Group CEO.

EasyEquities gained much popularity during the COVID-19 pandemic on the back of the surge in the popularity of retail investment platforms. During that time, it reported daily signups of between 1,500-2,000 users. By February 2002, the company was reportedly signing up 12,000 users per month.